Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Stay notified with free updates

Simply sign up Chinese business and money MEFT Digest – Directly delivered to your inbox.

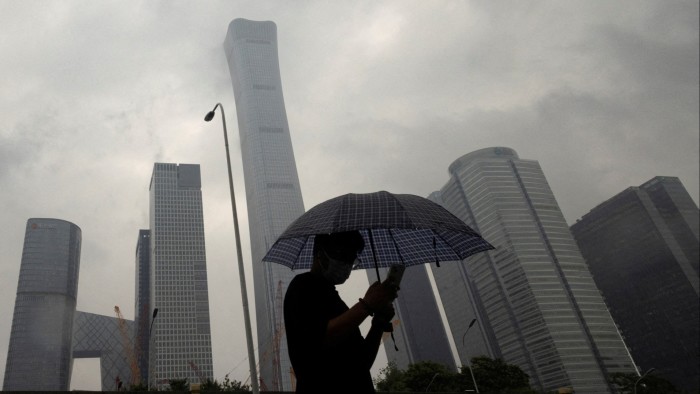

China pressures to integrate the financial sector and make economic push better enable the weather because it is accelerating the attempt to create large banks and brokerage.

In the last one year, about 20 people in the country have closed their doors, according to data ChinaThe National Financial Regulatory Administration in a clear combination of the banking sector after a one -year property crisis.

In separate data compiled by the S&P Global rating, the mergers have begun or operates more than one-fifth of the assets in the Chinese Securitys agencies at the end of the 2023.

The goal of the unification promotion is to convert China’s Histor to the fragmented financial sector and create a few powerful, dynamic companies that can compete like JP Morgan and Morgan Stanley.

President Xi Jinping has called for regulators before the regulators “to cultivate a number of top investment banks and investment entities to enhance the effectiveness of financial services for the real economy.” Last month, China has repeated the need to “increase the main competition of top -level investment banks through integration and acquisition of the China Securitys Regulatory Commission.”

A system even bigger Bank George Magnus, an associate of the China Center at the University of Oxford, says brokerage will help form Chinese financial policies for a long time for “front economic transformations.

The accelerated speed of the attachment reflects the belief of the authority that they have removed the worst risks from the financial system and can now be in shape to support China’s growth.

Ryan Sang, managing director of the S&P Global rating, said, “This may probably be a decade long process for a few years,” this process referred to half the complete. “The root is not just about reducing the number of organizations, but also about strengthening their skills in risk management.”

In recent years, Beijing Insolvent Grameen Banks closed, tried to reduce the risk in a huge overlocked financial system by cracking on Evergrand and pushing B. To reconstruct local governments to their debtThe

As a result, “China’s financial system is now the most stable level in the last decade,” said Richard Ju, a financial analyst at Morgan Stanley. “Time seems to be right to make the sector easier and to impress the skills.”

In 2021, analysts are expecting further consolidation between state -owned brokerage, trust companies and financial leasing groups, as policy makers are trying to create thin and more competitive financial institutions.

Over the years, after the credit-driven growth, authorities are trying to give the economy a new shape. As part of this, they want to reduce the number of banks. China’s 1,605 rural banks are about 5 percent of the country’s ND -owners, yet it operates only 5 percent of its total assets.

The collapse of the deals stream has also affected the brokerage of the injury. “We can see the wide shake-ups associated with multiple brokerage in the umbrella of the same-state resource directors,” said Karen Wu, a creditite in Singapore.

In Shanghai, the six state -owned brokerage residence, which is supervised by the local state -owned asset resource manager, Sasak, is pressing two of China’s oldest investment banks for a relationship between Gutai Junan and Haitang Securities, according to public announcement and the company’s fileing.

Beijing re -shape its institutions to navigate such a more unstable global economy, analysts expect more input as in international NDing, Debt ORODS in the decision of banking from Beijing to banking. Belt and road The country and the use of Renminbi.

“In all these activities, the Chinese Finance is about to cross the swords with US financial institutions, and so from the Chinese point of view it is self -defensively meaningful to empower China’s money industry,” Magnus.