Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The New CEO of the UnitedHealth Groalth group will get the hefty pay package that likes the board to give him?

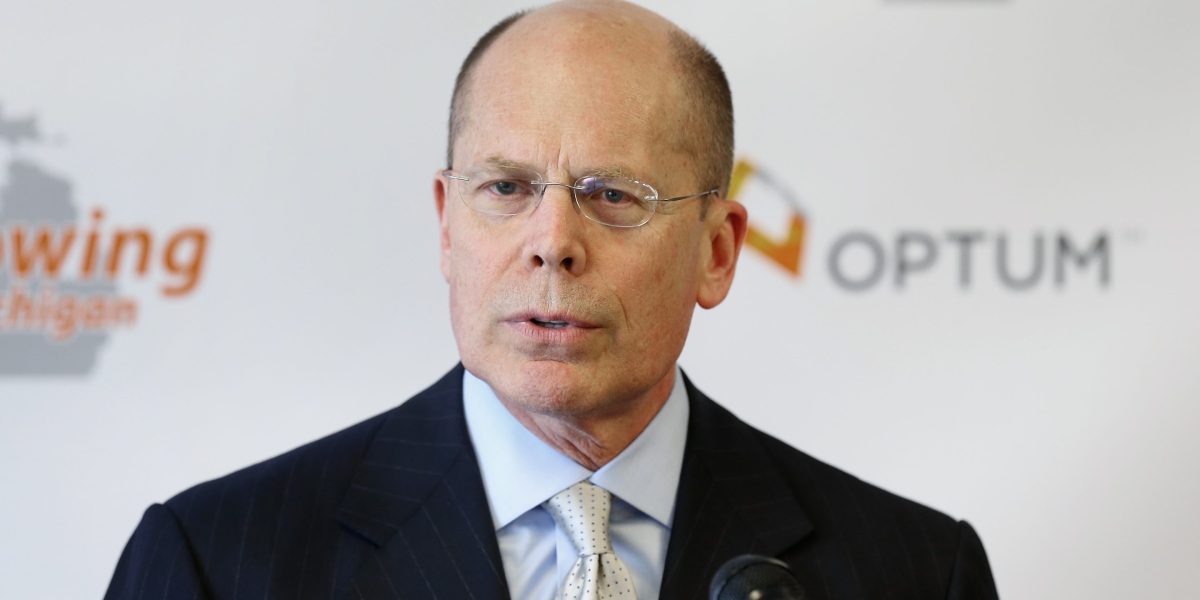

That the question of eight numbers will rise between the unchanged absence of UHG value in the last few weeks. UHG is the largest healthcare healthcare company, No. 3 in Fortune 500, but in April it explains awful showing in the first quarter. Stock price falls, then continues to crush out weeks. The CEO Andrew Witty has been rumbling suddenly because of unprecedented personal reasons, and the board chairman, Stephen Hemsley, was removed as CEO.

Hemsley, moving 73 in June, seek to save the colosus he has helped as CEO from 2006 to 2017 the most unique pay package they made for how.

He will get a base of salary $ 1 million a year of money but at the bottom of the usual salary for the sere-large companies. More importantly, he will get a chance of $ 60 million to give stock options, with a twist: he’ll only get the payment when he is going to be CEO in three years. He cannot get other stock-based awards at that time.

Shareholders vote on the unrealized payment plan in UHG June. Institutional shareholder services, the largest company advising major shareholders how to vote, advising they voted not.

His saw many problems with Pace Pace Pave Pace Paveko. Such a large, full-faced, multiyear awards “restricts the ability to the board of meaningful adjustment of future payment opportunities,” as the issues. In addition, Hemsley should not fulfill any performance behavior to obtain the award of the Mammoth Stock Award; He got the whole thing in a day. Hemsley also got the award like the bad news binding about the part of the lowest of nearly five years, which could he get “a windfall” a “rebound in part.” Combined those reasons, the issues said, and no vote “is now marked.”

UHG turns back, sending shareholders an explanation of what said missed and why they should vote for Hemsley’s pay package. The central point of the company: “Only the award is worth whether and the size of the shareholder is made.” As for the “windfall” argument, UHG says “in real all [underlined and bold in the UHG document] Shareholders get from the stock stock price increase in the company at the current level. “

Who is likely to win this vote? Lower line, Hememley and UHG may get the pay package they set. Recommendations of issues are made seriously, but shareholders usually vote in favor of handling. Even if the UHG is lost to shareholder voting, which companies must be maintained by law, the result is not nonbinding and advisory; The board of directors can only ignore the shareholders want. In addition, UHG says the main competitor of the issue, Glass Lewis, shareholders voted in Hemsley’s pay package. “In a look at the waste,” it tells its clients, “[Hemsley’s] The annual fee is not over. “

Regardless of the consequence, the controlling vote is important. It will increase high stakes for UHG, directors, and hemsley. Three years from today, success either the opposition looks at all the most heroes – and failure to be more bitter.

This story originally shown Fortune.com