Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The same technology giants helped dragging S & P 500 to a Abril’s bear market giving healing of single legs.

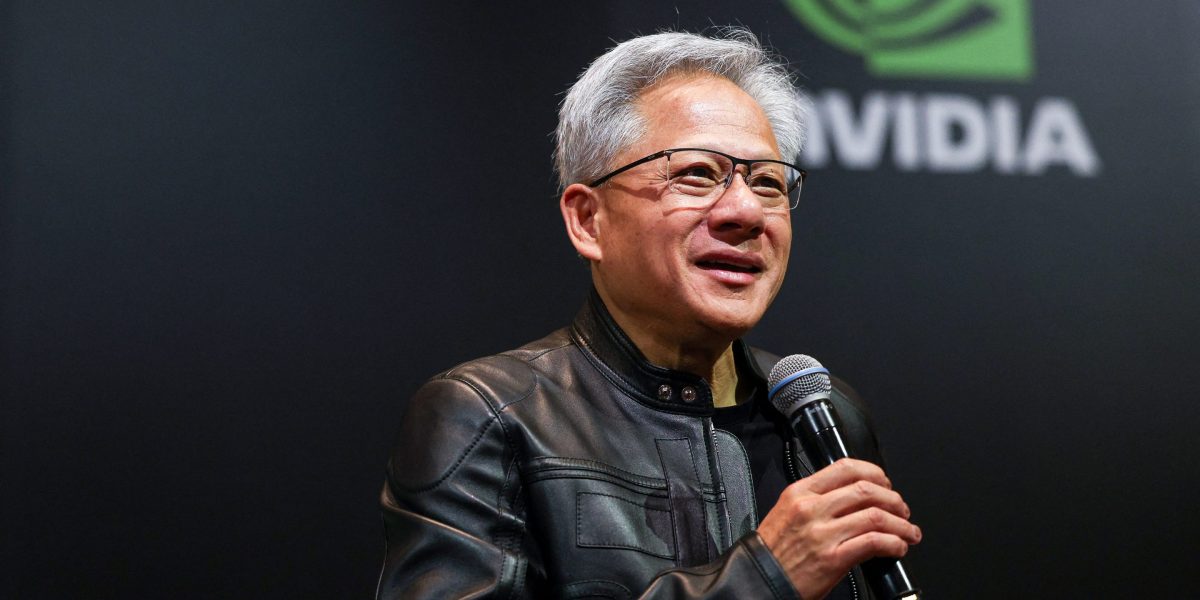

NVIDIA The Corp. put a bow in a better expected income period for big tech last weekconsumeA strong sight for income, despite US restrictions on selling its chips in China. With nvidia and Microsoft Rallying in Corp. Back to CUSP of Record Highs, entrepreneurs bet on the group targeting the wider market.

“I feel good about tech to go out at this time of earnings,” said Brett Ewing, Chief Market Strategist at First Franklin Fancial Services. “There’s more gas in this tank.”

The S & P 500 Index is within 4% February records with high rebounds between US and digital advertising, electronic advertising tens between US tech colleagues

Tesla The Inc. It’s up to 56% since the benchmark of April 8, while NVIDIA and Microsoft earn 40% and 30%, actually.

As a result, a bloomberg gauge in so-called beautiful seven stock – Nvidia, Microsoft, Tesla, apple Inc., Alphabet Inc., Amazon.com Inc. and Meta platforms Inc. – Outperforming on S & P 500 over the past eight weeks – a critical shift for benchmark considering group accounts for a third of the index. The cohort is responsible for almost half of the S & P 500 rally from the bottom of April, according to the bloomberg compiled data.

Despite the strong performance, the group still traveled to S & P 500 for the year – aUnique eventin the last decade. Apple and Amazon parts, facing more risks from tariffs due to imported products, weighing cohort and struck the overall market.

“Buying Tech Dy Dapt is a theme throughout the year,” Ewing said. “There’s a lot of money on tracks and it should be done.”

Tariffs and other trumpet plots remain a large overhang market. On Friday, the benchmark fell more than 1% after TrumpRESPONDENTChina in violation of a US agreement to ease tariffs and a newsreportthat the US plans to put wider restrictions in the country’s tech sector. The S & P 500 has been able to reconcile most of the losses at the end of the day.

Another hurdle can be heavy tech valuations. The noble seven gauge in Bloomberg is worth 30 times expected income, according to the data gathered in Bloomberg. Meanwhile, the S & P 500 is trading of 21 hours of income expected in the next 12 months, from a bit 18 times in Abil 18.6 hours in the last decade.

Barry Knapp, Maconsides Macroeconomics Partner, said he has a lot of Big Tech values even if the group looks attractive from a basic sight. He is “moderate weight” the sector and have more exposure to industries, materials, energy and financial expectations of capital healing in the second half of the year.

“Due to the tech’s overweight here the boundaries of joke, because you have such great proportion to your portfolio in this sector,” Knappp said.

However, Truist Advisory services Keith Lerner, see many tech leading the wider market at the last half of 2025 with spending artificial computation that continues to climb.

Meta platforms grow in predicting it for capital expenditures this year and Microsoft says it plans toIncrease spendingIn the next fiscal year, relieving concerns companies can return such outlays after two years of Maysesse.

“Our view is that income can still be stealthy but probably less downside than what we think of the chiefing seoper and the chief market investment.

The odd seven estimates of 2025 remain steady in the past two months. The group was expected to deliver profit growth of 15%, almost by the analysts before reporting during the mid-April 500, according to the data gathered in Bloomberg.

“Investors will restore these names with secular growth,” Lerner said. Tech “can cause the latter to look at the market easy to accelerate later in the year.”

This story originally shown Fortune.com