Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Stay informed with free updates

Simply sign up EU power myFT Digest — delivered straight to your inbox.

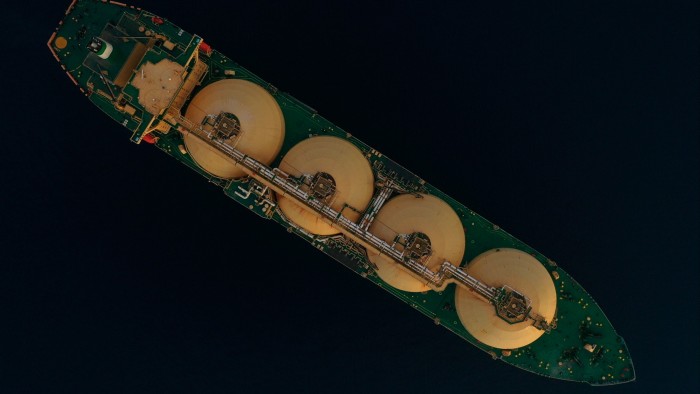

Russia’s liquefied natural gas imports to the European Union hit a record high this year despite the bloc’s efforts to reduce its dependence on gas from the country following Moscow’s full-scale war on Ukraine.

Europe imported a record 16.5 million tonnes of Russian LNG through mid-December, up from 15.18 million tonnes last year, according to commodity data provider Kepler. This amount is higher than the last record of 15.21 million tonnes imported in 2022.

“What we’ve seen this year is staggering,” said Anna Maria Zalar-Makarewicz, an analyst at the Institute for Energy Economics and Financial Analysis. “Instead of gradually reducing Russian LNG imports, we are increasing them.”

Following Russia’s full-scale invasion of Ukraine in 2022, the EU aims to stop importing any goods Russian fossil fuels by 2027But super-chilled gas shipments to European ports have continued to grow.

Unlike gas imports via pipelines, which have declined, and Russian oil and coal, which are banned in the EU, Russian LNG imports are still permitted and growing, a sign of how a “terrified” Europe is still struggling to wean. Cheap supply itself is off, Jaller-Makarewicz said.

Analysts point to increased purchases of Russian LNG on the spot market this year — 33 percent of EU imports of Russian-origin LNG are made under spot contracts, compared with 23 percent last year, said Rystad Energy, an energy consultancy.

Companies such as Shell and Equinor have announced that they are not buying Russian LNG on the spot market. Other traders said that since the attacks, contracts for spot cargoes often contain clauses guaranteeing that the LNG is “not of Russian origin”.

However, spot trade has picked up this year as traders “can supply cargo at affordable prices [from Russia]”, says Christoph Halser, gas analyst at Riestad.

He added that prices for LNG shipped to Europe from Russia’s Yamal terminal were “significantly lower” than gas shipped from the United States.

Europe previously imported about two-fifths of its gas from Russia, much of it through pipelines. Now, overall gas imports from Russia, including pipeline gas, account for about 16 percent of the EU’s gas supply.

EU officials are adamant that the bloc does not need Russian fuel, even if it means accepting higher prices to buy gas elsewhere.

But Russian LNG accounted for 20 percent of the EU’s overall imports of seaborne fuel this year, up from 15 percent last year, ship tracking data showed. Not all Russian LNG brought to Europe is consumed in the region, some is reloaded and sent to other parts of the world.

Volume in France jumped this year, almost doubling from 2023. More than half of the shipments go to the import terminal in Dunkirk, according to Kepler data.

French energy companies EDF and TotalEnergies, as well as German state-owned energy company Sefe, have contracts to use the terminal there.

Belgium was the second-largest importer of Russian LNG as its port of Zeebrugge is one of the few European points for regular cargo ships transporting LNG from ice-class tankers used in the High North. EU governments have agreed to ban the transshipment of Russian LNG from Yamal to non-EU countries, a measure that will come into force in March 2025.

Dan Jurgensen, the EU’s new energy commissioner, has promised to present a plan next year on how the bloc can meet its 2027 target to wean itself off all Russian fossil fuels.

European Commission President Ursula von der Leyen hinted in October that the bloc could boost US imports as a way to appease US President-elect Donald Trump, who has threatened sweeping trade tariffs.

Trump warned That the EU must commit to buying “large scale” amounts of US oil and gas or face tariffs.

Additional reporting by Ray Douglas and Daria Mosolova